(Updated) Modeling Suggests Substantial Increases In The Financial Vulnerability Of Hawaii's Families

Note: This is an update to our earlier piece on this topic.

Significant financial impacts from COVID-19 expected for all income levels in Hawaii

Although the specifics of COVID-19’s economic effects on Hawaii remain unclear, our modeling suggests impacts on households of all income levels. Based on preliminary results, we estimate that nearly 134,000—approximately 30 percent—of all Hawaii households stand to bear a significant loss of income (defined as a loss in household income greater than 25 percent) due to the effects of the pandemic on the local economy.

Without assistance, ALICE households are likely to swell, with some pushed into poverty

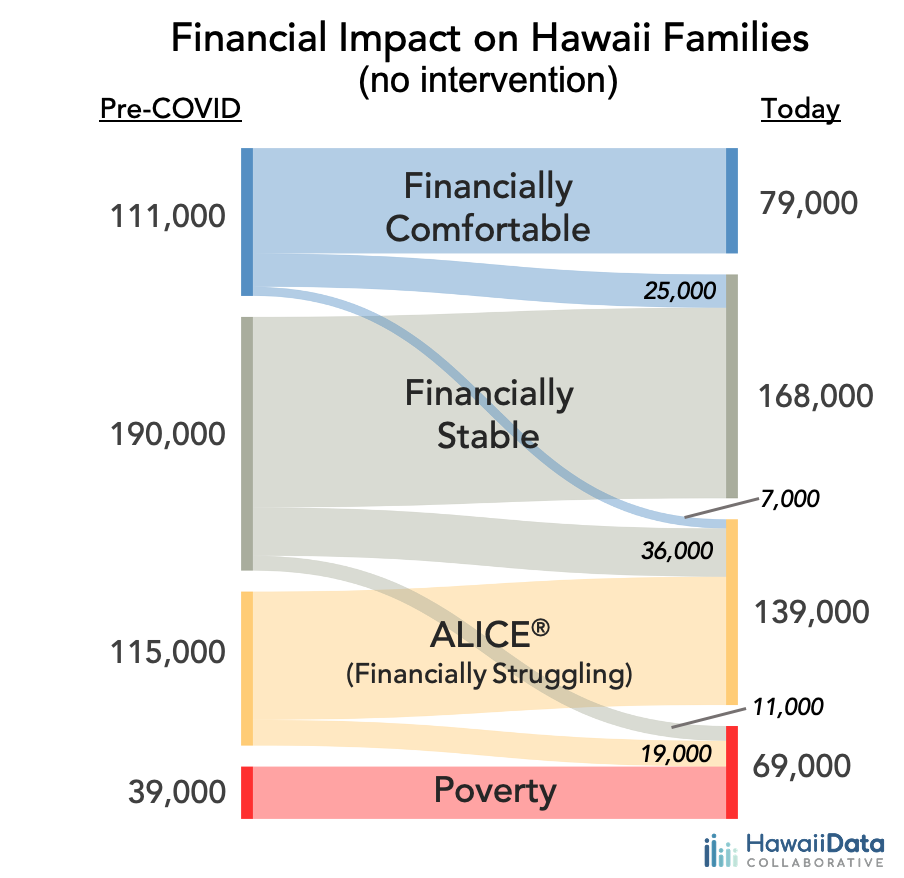

How to read this graph:

On the left are the number of households sitting within different levels of the ALICE household survival budget.

The “Comfortable” income group earns 250 percent or more of the ALICE survival budget, adjusted for household characteristics. In other words, households in this top level are faring well financially.

The levels go down in increments of 100 percent of an ALICE household survival budget, with ALICE households sitting in the 51-150 percent band.

This graph shows the estimates of how many households from the pre-COVID status on the left will move to a different status in our post-COVID economy – just follow the lines from left to right.

Based on income thresholds from Aloha United Way’s Asset Limited Income Constrained Employed (ALICE) income and household expense criteria, low-income, working households are at particular risk for these economic effects. ALICE households earn more than the federal poverty level, but less than the basic cost of living for their state. In Hawaii, ALICE households number approximately 115,000 in our model*; the current financial shock could increase the number of Hawaii’s ALICE households by 24,000.

What is more, COVID-19 may prove to be a tipping point into poverty for many existing ALICE families. Of the 30,000 ALICE households projected to experience significant financial impact due to the pandemic, as many as 19,000 could slip into poverty (losing half or more of their pre-COVID incomes) without support.

Finally, by sheer numbers, households in the “Financially Stable” category stand to be the most affected by the COVID-19 crisis. Of the approximately 190,000 Financially Stable households in Hawaii, an estimated 36,000 (19 percent) are projected to fall into ALICE status post-COVID-19.

Current government assistance mitigates dramatic shifts… for now

The graph above is illustrative of where families are right now based on their income stream, but it does not account for government assistance programs such as the Economic Impact Payment check, Hawaii State Unemployment Insurance, and federal supplementary unemployment insurance as part of the CARES Act. We looked carefully at the criteria for these programs and applied them to our model.

Essentially, we find that, in the short term, government assistance mitigates much of the financial hardship that many families would find themselves in given the COVID-19 economic shock. Most critically, these programs are protecting nearly 30,000 families from slipping into poverty and 23,000 from falling into ALICE from Financially Stable or Comfortable. However, even with these programs, approximately 20,000 more families are now in the precarious ALICE situation than before COVID.

In the longer term, government relief will not be able to sustain this level of assistance. While we anticipate the gradual re-opening of our economy in the coming weeks and months, it is clear this will not be a full re-opening. Hawaii’s families will continue to remain financially vulnerable until we see broader economic recovery, and it will be important to understand, using models such as ours, who these families are likely to be, which communities will have the greatest numbers of families that are struggling, and what types of support are most needed. We will continue to provide these estimates, along with tools for working more deeply with the model and data, in the coming weeks as the full economic situation continues to unfold.